Introduction

The Minister of Finance, Mr. Eric Girard, tabled his 2024-2025 budget plan on March 12, 2024, which plans to support seniors, to improve the fairness and impact of tax credits supporting jobs in the information technology sector and to enhance support for Québec film and television production.

Here are the highlights of the 2024-2025 budget.

Measures pertaining to individuals

Changes relating to the supplements for handicapped children under the refundable tax credit granting an allowance to families

The government will be modifying the eligibility criteria for the supplements for handicapped children under the Family Allowance.

Budget 2024 plans to:

- simplify and update the eligibility and assessment criteria for the Supplement for Handicapped Children to ensure they are more readily understandable;

- In this regard, the various tables of presumed cases of serious handicap related to an impairment, presented in Part 1 of Schedule A of the Regulation respecting the Taxation Act, will be replaced by new tables[1].

- modify the eligibility criteria for the Supplement for Handicapped Children Requiring Exceptional Care so that certain severely disabled children under age 2 who are currently ineligible can benefit from it.

These modifications will apply as of July 1, 2024.

Supporting seniors with disabilities

Eliminating the pension reduction starting at age 65

A person eligible for a disability pension who reaches the age of 60 can apply for their retirement pension, which is reduced based on the number of months the pension is received prior to turning 65. When this person reaches age 65, they stop receiving the disability pension, but they continue to receive a reduced retirement pension for the rest of their life.

The government is announcing that, as of January 1, 2025, it will completely eliminate the retirement pension reduction for seniors with disabilities reaching the age of 65.

Protecting benefits

The new disability and retirement pensions are set according to wage growth while pensions already being paid are indexed to price trends. Some recipients of a disability pension may experience a slight reduction when their disability pension is converted to a retirement pension.

Amendments will be proposed to protect the benefits of recipients of a disability pension between the ages of 60 and 64, more specifically to ensure that their benefits are at least as high as what they were prior to the payment of their retirement pension.

This protection will apply retroactively to January 1, 2024.

Continuing the assistance offered by the Shelter Allowance Program

The maximum assistance under the program has depended on the portion of household income[2] spent on housing costs, that is:

- $100 per month if 30% to 50% of their income is spent on housing;

- $150 per month if 50% to 80% of their income is spent on housing;

- $170 per month if 80% or more of their income is spent on housing.

It was planned that the first level of assistance, corresponding to $100, would be granted on a temporary basis, until September 30, 2024. The government is announcing to continue the assistance offered by the Shelter Allowance Program until September 30, 2027.

Measures pertaining to businesses

Enhancement of the refundable tax credit for Québec film or television productions

The tax legislation will be amended to increase the limit from 50% of production costs to 65% of production costs incurred and directly attributable to film production.

This change will apply in respect of a Québec film production for which an application for an advance ruling, or an application for a certificate if no advance ruling was previously filed in respect of this production, is filed with the Société de développement des entreprises culturelles (SODEC) after March 12, 2024.

Adjustments to the refundable CSPC

The government plans to increase the base rate for the tax credit from 20% to 25%.

The government also plans to ensure that only 65% of the value of a visual effects and animation contract granted in Québec is considered an eligible expense under the tax credit for film production services (CSPC).

- This 65% portion of eligible expenditures will apply to both the base rate, increased to 25%, and the 16% enhancement for visual effects and animation.

These changes will apply in respect of a qualified production for which an application for an approval certificate will be submitted to the SODEC:

- after March 12, 2024 if the SODEC deems that work on the production was not sufficiently advanced on March 12, 2024;

- after May 31, 2024, in all other cases.

Changes to the TCEB

Introduction of an exclusion threshold per eligible employee and removal of the limit applicable to an eligible employee

Introduction of an exclusion threshold per eligible employee

The tax legislation will be amended to exclude from the tax assistance available to a qualified corporation under the tax credit for e-business development (TCEB) the first dollars of qualified wages it has incurred and paid in respect of an eligible employee, for a taxation year.

Accordingly, a qualified corporation will have to subtract, for a taxation year, from the amount of qualified wages incurred and paid in respect of an eligible employee, the amount corresponding to the excluded wages for that taxation year.

Determination of the amount of excluded wages

The amount of excluded wages relating to qualified wages incurred and paid by a qualified corporation, for a taxation year, will be equal to the lesser of the following amounts:

- the amount corresponding to the qualified wages incurred and paid by a qualified corporation in respect of an eligible employee for the taxation year;

- the amount corresponding to the exclusion threshold applicable to qualified wages for the year.

Exclusion threshold applicable to qualified wages

The exclusion threshold applicable in respect of qualified wages incurred and paid, for a taxation year, by a qualified corporation in respect of an eligible employee, will correspond to the amount taken into account in calculating the basic personal tax credit[3] for the calendar year in which the qualified corporation’s taxation year begins, adjusted to take into account the number of days in the taxation year of the qualified corporation where the employee qualifies as an eligible employee.

Removal of the $83 333 limit

The tax legislation will be amended to remove the current $83 333 limit on the definition of the expression “qualified wages” for each eligible employee.

Application date

These changes will apply in respect of a taxation year beginning after December 31, 2024.

Increase in the non-refundable tax credit and corresponding reduction in the refundable tax credit

The tax legislation will be amended to gradually increase the non-refundable tax credit until 2028.

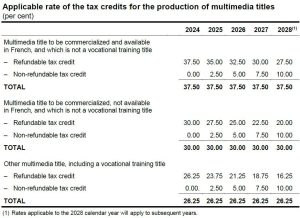

Applicable TCEB rates

(per cent)

(1) Rates applicable to the 2028 calendar year will apply to subsequent years.

Application date

Changes to the tax credit rates will take effect on January 1 of each calendar year concerned.

A qualified corporation whose taxation year does not correspond to the calendar year must, in the calculation of its tax credits for a taxation year, take into account the rates in effect for the calendar year in which its taxation year begins.

Changes to the tax credits for the production of multimedia titles

Introduction of an exclusion threshold per eligible employee and removal of the limit applicable to an eligible employee

Introduction of an exclusion threshold per eligible employee

The tax legislation will be amended to exclude from the tax assistance offered to a qualified corporation under these tax credits, the first dollars of salary or wages that a corporation has incurred and paid, or that a subcontractor with which it does not deal at arm’s length has incurred and paid, in respect of an eligible employee, for a taxation year.

Therefore, a corporation will have to subtract an amount corresponding to the excluded salary or wages, for a taxation year, from the amount of salary or wages attributable to a multimedia title that it incurred and paid in respect of an eligible employee, for eligible production work relating to the multimedia title for that taxation year.

In addition, a corporation will be required to subtract an amount corresponding to the excluded salary or wages, for a taxation year, from the portion of the consideration that a corporation paid, under a contract, to a subcontractor with whom it was not dealing at arm’s length at the time the contract is entered into and that is attributable to the amount corresponding to the salary or wages attributable to a multimedia title that this subcontractor incurred and paid in respect of an eligible employee, for eligible production work relating to the multimedia title for that taxation year.

Determination of the amount of excluded salary or wages

The amount of excluded salary or wages relating to salary or wages that a corporation has incurred and paid, or that a subcontractor with which it does not deal at arm’s length has incurred and paid, for a taxation year, will be equal to the lesser of the following amounts:

- the amount corresponding to the salary or wages attributable to a multimedia title that a corporation or a subcontractor with which it does not deal at arm’s length has incurred and paid in respect of an eligible employee for eligible production work relating to a multimedia title for the taxation year;

- the amount corresponding to the exclusion threshold applicable to salary or wages for the year.

Exclusion threshold applicable to salary or wages

The exclusion threshold applicable in respect of salary and wages incurred and paid, for a taxation year, by a corporation in respect of an eligible employee, or in respect of an eligible employee of a subcontractor with whom the corporation does not deal at arm’s length, will correspond to the amount taken into account in calculating the basic personal tax credit[4] for the calendar year in which the corporation’s taxation year begins, adjusted to take into account the number of days in the taxation year of the corporation where the employee qualifies as an eligible employee.

Removal of the $100 000 limit

The tax legislation will be amended to remove the $100 000 limit applicable to a salary or wages covered by the definition of the expression “qualified labour expenditure” for each eligible employee.

Application date

These amendments will apply in respect of a taxation year that will begin after December 31, 2024.

Introduction of a non-refundable tax credit and corresponding reduction in the refundable tax credit

The tax legislation will be amended to introduce two new non-refundable tax credits for the general and specialized components. The initial rates of these tax credits will be 2.5%, rising by 2.5 percentage points annually to eventually reach 10% in 2028 (see table 1 in the appendix).

The portion of the tax credit that does not reduce the tax payable of a qualified corporation for the taxation year to which the tax credit applies may be carried back 3 taxation years or carried forward 20 taxation years. However, this carry-over will not be allowed for a taxation year for which the corporation is not entitled to the tax credit nor for a taxation year that begins before January 1, 2025.

In this regard, amendments will be made to the tax legislation so that a qualified corporation can request to carry back the unused portion of the tax credit for a taxation year when it first claimed the tax credit within the aforementioned time periods.

Application date

The changes relating to the introduction of the non-refundable tax credit will apply in respect of a taxation year beginning after December 31, 2024.

The changes to the rates of the refundable and non-refundable tax credits components will take effect on January 1 of each calendar year concerned.

A qualified corporation whose taxation year does not correspond to the calendar year must, in the calculation of its tax credits for a taxation year, take into account the rates in effect for the calendar year in which its taxation year will begin.

Abolition of the tax credit to foster the retention of experienced workers

The tax legislation will be amended to abolish the tax credit for experienced workers in respect of an amount paid by the corporation or partnership, as the case may be, as employer contributions attributable to a date later than the March 12, 2024.

More specifically, any amount paid by a qualified corporation or a qualified partnership, as the case may be, as employer contributions will only be considered an eligible contribution if it relates to the portion of salary, wages or other remuneration paid, allocated, granted, awarded or attributed by the corporation or partnership in the calendar year to an employee, and that is attributable to a date prior March 13, 2024.

Measures pertaining to commodity taxes

Increases in the specific tax on tobacco products as part of tobacco control efforts

The government is announcing two increases in the specific tax on tobacco products of $2.00 each per carton of 200 cigarettes.

The rates of this tax will be changed a first time on March 13, 2024 and a second time on January 6, 2025.

Increase in the number of years covered by the Guide d’Évaluation Hebdo (Automobiles et Camions Légers)

The Québec sales tax (QST) system includes rules to determine the market value of such vehicles for the purposes of calculating the QST payable on their sale. Thus, the amount of QST payable is generally calculated on the greater of the sale price agreed upon by the parties to the transaction, or the average wholesale price listed in certain reference volumes less $500.

The number of years covered by the average wholesale price listed in the Guide d’Évaluation Hebdo (Automobiles et Camions Légers) published by Société Trader Corporation will be increased from 9 to 14, starting on January 1, 2025.

Bringing into Québec of a road vehicle

The QST system provides for an anti-avoidance rule to determine the market value of used road vehicles for the purposes of calculating the tax payable regarding the selling or bringing into Québec of these vehicles.

The QST system will be amended so that the estimated value rule does not apply to a used road vehicle brought into Québec following its transfer, outside Québec, between related individuals.

This change will apply in respect of such used road vehicles brought into Québec after the March 12, 2024.

Other measures

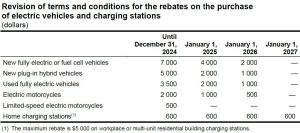

Reducing Roulez vert program rebates

The government is announcing that the rebates for the purchase of an electric vehicle will be reduced gradually starting on January 1, 2025, and will stop being offered on vehicles registered on or after January 1, 2027[5]. These vehicles also continue to be eligible for the federal government’s $5 000 rebate until March 31, 2025, or until the funds run out (see table 2 in the appendix).

Ensuring support payments are received on a regular basis

A new deterrent measure will be introduced, allowing for the suspension of the driver’s licence of highly uncooperative payors who seek to avoid making the support payments they are legally bound to make.

Appendix – Table 1

Appendix – Table 2

Notice to Users

The reproduction of the contents of this Québec budget summary is authorized without restriction.

This budget summary is based on the documents issued by the Québec government. The legislation, when enacted, may vary from the summary described herein. Professional advice should be obtained.

PSB BOISJOLI LLP has acted solely as publisher of this budget summary. Consequently, neither PSB BOISJOLI LLP nor any person involved in its preparation accepts any liability for its contents or for any consequences arising from its use.

[1] See Additional Information of Budget 2024-2025, section 1.1.1 Supplement for handicapped children, table A.1.

[2] The program is aimed at low-income households, renters or owners with at least one dependent child or one person aged 50 or older.

[3] For illustrative purposes, for 2024, the amount is $18 056.

[4] For illustrative purposes, for 2024, the amount is $18 056.

[5] Rebates on limited-speed electric motorcycles will cease on January 1, 2025