The federal budget has proposed increasing the inclusion rate on capital gains from 50% to 66.667%.

The proposal applies to capital gains realized on or after June 25, 2024. There is a $250,000 “safe harbour” for individuals.

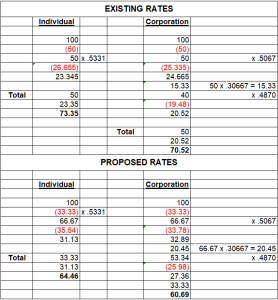

Assuming that [1] Québec harmonizes and [2] that RDTOH rates remain the same, the chart below summarizes the impact of the change.

[1] There will be significant activity. We anticipate that there will be significant structuring activity between now and June 24, 2024 to lock in the existing rate.

[2] We encourage you to identify clients that may require assistance immediately.