REVISIONS TO SMALL BUSINESS DEDUCTION

In its budget of March 16, 2016, the Quebec government made significant changes to the small business deduction (“SBD”) rules for Canadian controlled private corporations (“CCPCs”), which will take effect for taxation years beginning on or after January 1, 2017.

In its budget of March 16, 2016, the Quebec government made significant changes to the small business deduction (“SBD”) rules for Canadian controlled private corporations (“CCPCs”), which will take effect for taxation years beginning on or after January 1, 2017. A new eligibility requirement has been introduced, to the effect that Quebec CCPCs will need to demonstrate that their employees worked 5,500 hours in the year in order to qualify for the Quebec SBD.

In its budget of March 22, 2016, the Federal government also announced changes to the determination of the SBD – using a completely different approach. The Federal changes target CCPCs that receive payments from other corporations if certain conditions are met. Starting with taxation years that begin after budget date, then, and in the absence of changes to these new rules, Quebec CCPCs will have to determine whether they qualify for the Federal SBD, the Quebec SBD, both, or neither. As a consequence of these changes and the timing for their implementation, owner-managers will need to plan their salary/dividend mix carefully, taking into account the various tax rate changes.

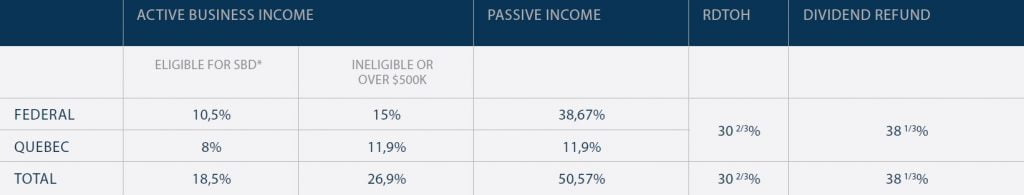

A summary of the tax rates applicable to CCPCs in 2016 and 2017 is set out in the following tables:

* Note that effective March 22, 2016, unless certain conditions are met, the new rules may disqualify a CCPC from claiming the SBD even where their active business income is below the $500k threshold. In that case the tax rate matches the “ineligible or over $500k” column.

{…}