On July 17, 2020, the federal government announced it is proposing a further extension of the Canada Emergency Wage Subsidy program (“CEWS”) until December 19, 2020.

New CEWS Rules starting July 5, 2020

Effective July 5, 2020, the CEWS will consist of two parts:

- a base subsidy available to all eligible employers that are experiencing a decline in revenues, with the subsidy amount varying depending on the scale of revenue decline (“Base CEWS”); and

- a top-up subsidy of up to an additional 25 per cent for those employers that have been most adversely affected by the COVID-19 crisis (“Top-Up CEWS”).

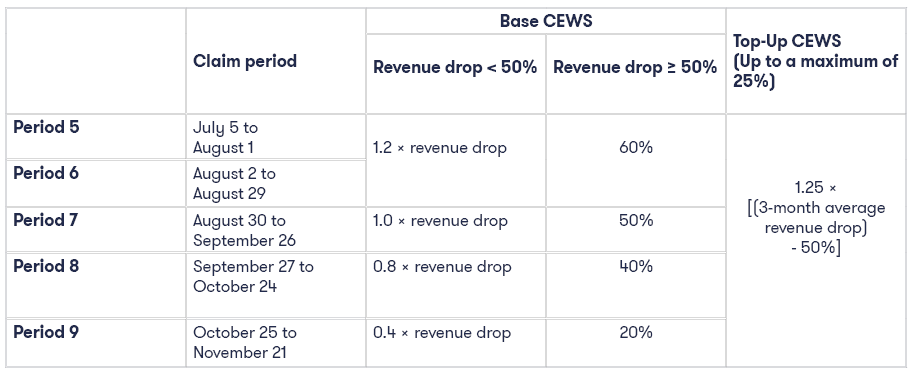

Base CEWS

For periods beginning July 5, 2020, employers that have been affected by the COVID-19 crisis will be eligible to receive the Base CEWS for active employees. The Base CEWS will be a specified rate, applied to the amount of remuneration paid to the employee for the claim period, on remuneration of up to $1,129 per week.

The Base CEWS varies depending on the level of the revenue decline, and its application will be extended to employers with a revenue decline of less than 30 per cent. This expansion means that all eligible employers with a revenue decline will now qualify for the Base CEWS.

The maximum Base CEWS rate will be available to employers with a revenue drop of 50 per cent or more.

Top-Up CEWS

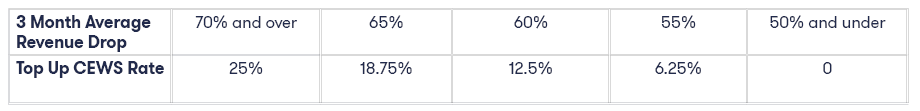

The Top-Up CEWS provides an additional subsidy of up to 25 per cent. Generally, an eligible employer’s entitlement to the Top-Up CEWS will be determined based on the revenue drop experienced when comparing revenues in the preceding 3 months, either to the same months in the prior year or compared to an average of revenue earned in January and February 2020.

Employers that have experienced a 3-month average revenue drop of more than 50 per cent would receive a Top-Up CEWS rate equal to 1.25 times the average revenue drop that exceeds 50 per cent, up to a maximum top-up CEWS rate of 25 per cent (attained at a 70‑per‑cent revenue decline).

The Top-Up CEWS rate applies to a maximum of $1,129 of remuneration per week per eligible employee.

Top-Up CEWS Rates

Combined Base CEWS and Top-Up CEWS Summary Table

Employers who have been subject to a revenue decline of 30% or more and who would have been better off using the initial CEWS structure will be able to elect to receive the 75% wage subsidy in periods 5 or 6.

Eligible Employee

An eligible employee is an individual who is employed in Canada. Effective July 5, 2020, the eligibility criteria no longer excludes employees that are without remuneration in respect of 14 or more consecutive days in a claim period.

Calculating Revenue

Reference Periods for the Drop-in-Revenue Test

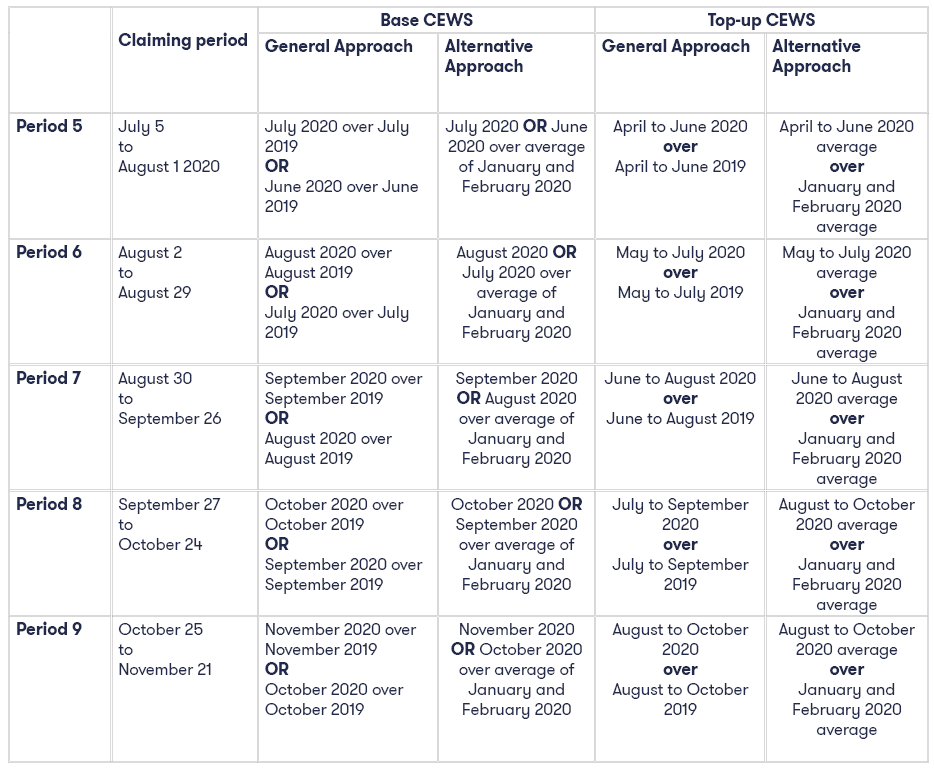

For the purpose of the Base CEWS, eligibility is determined by the change in an eligible employer’s monthly revenue, year-over-year, for the applicable calendar month (“General Approach”), or in comparison to an average of revenue earned in January and February 2020 (“Alternative Approach”).

Employers that have elected to use the Alternative Approach for the first 4 periods have the choice of reverting to the General Approach for Period 5 and onward. Similarly, employers that have used the General Approach for the first 4 periods can elect to use the Alternative Approach for Period 5 and onward. The chosen approach applies for Period 5 and onward for the purposes of both the Base CEWS and the Top-Up CEWS.

For Period 5 and all subsequent periods, an eligible employer can use the greater of its percentage revenue decline in the current period or the immediately previous period to determine Base CEWS eligibility.

Eligibility for the Top-Up CEWS is based on the change in the eligible employer’s revenues for the previous 3-month period.

Reference Periods for the Drop-in-Revenues Test Summary Table

Other Changes

- Continuity rules will be provided where the employer purchased all or substantially all the assets used in carrying on business by the seller;

- Prescribed organizations that are registered charities or non-profit organizations will be allowed to choose whether to include government-source revenue for the purpose of computing their reduction in qualifying revenue; and

- Entities that use the cash method of accounting will be allowed to use accrual-based accounting to compute revenue for the purpose of the CEWS;

- The definition of “baseline remuneration” (i.e. pre-crisis remuneration) will be amended to include wages earned in 2019. Before this, baseline remuneration meant remuneration earned in January and February 2020.