The alternative minimum tax increase applies January 1, 2024. The changes will negatively affect tax be paid on capital gains and employee stock options. The proposals will also have a significant impact on charitable donation planning (including flow through shares).

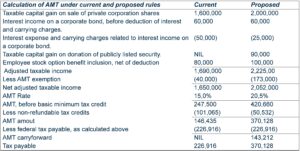

The following tables from the Canadian Tax Journal provides a great example of the potential effects:

Chris Watt Bickley, Sonia Gandhim Dino Infanti and Bessy Triantafyllos.

Chris Watt Bickley, Sonia Gandhim Dino Infanti and Bessy Triantafyllos, “Personal Tax Planning” (2023) 71:3 REVUE FISCALE CANADIENNE/ CANADIAN TAX JOURNAL 877-84, “Personal Tax Planning”,