Introduction

The Minister of Finance, Mr. Eric Girard, tabled his 2025-2026 budget plan on March 25, 2025, which plans to introduce a new, simplified and enhanced tax assistance system to stimulate research, innovation and commercialization, to redirect tax assistance to artificial intelligence solutions and to eliminate inefficient or little-used tax expenditures.

Here are the highlights of the 2025-2026 budget.

Measures pertaining to individuals

Changing the age requirement for eligibility for the refundable tax credit for child care expenses

As of the 2026 taxation year, the age of 16 included in the definition of “eligible child”, for the purposes of the tax credit for child care expenses, will be reduced to 14.

Consequently, an eligible child of an individual or of an individual’s spouse will have to be under 14 years of age at any time during the year for child care expenses incurred for the child in the year to be eligible for the tax credit for child care expenses for that year.

This change does not apply to children who are dependent due to a severe and prolonged impairment in mental or physical functions.

Enhancing the Family Allowance for bereaved parents

The tax legislation will be amended to provide that Family Allowance payments, as well as the Supplement for Handicapped Children (SHC) or the Supplement for Handicapped Children Requiring Exceptional Care (SHCREC) payments, where applicable, will be extended for 12 months from the month following the month that includes the day of an eligible dependent child’s death.

Application date

This new measure will apply in respect of a death occurring after June 30, 2025.

Adjusting the term “practitioner” used in the personal income tax system

Starting in 2026, only medical expenses for health services provided by practitioners who are members of a professional order in Québec will be eligible for the tax credits for medical expenses.

This will have the effect of harmonizing more closely with the federal tax credit by excluding medical expenses for alternative medicine services, such as those provided by homeopaths, osteopaths, naturopaths and phytotherapists.

New criteria for designating educational institutions recognized by Revenu Québec

As of 2026, new designation and exclusion criteria will be introduced to enable Revenu Québec to better oversee the process of recognizing institutions eligible for the non-refundable tax credit for tuition and examination fees.

Change to the deduction in respect of the cooperative investment plan

The tax legislation will be amended so that, for the purposes of the deduction in respect of the second cooperative investment plan (CIP deduction), the adjusted cost of a qualifying security for an individual will be the cost of that security (100 %), determined without taking into account borrowing costs and other costs related to the acquisition, instead of 125% of such cost.

Application date

This change will apply in respect of a qualifying security acquired after March 25, 2025.

For greater clarity, the rules relating to the 30% limit on total income applicable to the CIP deduction remain unchanged.

Transformation of two deductions into tax credits

Starting in 2026, two deductions will be converted to non-refundable tax credits at the base rate of 14%:

- the religious residence deduction;

- the deduction for assistance received for the payment of tuition fees for adult basic education programs.

Abolition of tax measures

As of the 2026 taxation year:

- abolishing the tax shield;

- abolishing the non-refundable tax credit for municipal political parties.

As of March 26, 2025:

- abolishing the foreign researcher tax holiday;

- abolishing the foreign expert tax holiday;

- abolishing the tax holiday for foreign specialists assigned to operations of an international financial centre;

- abolishing the tax holiday for foreign specialists working in the financial services sector;

- abolishing the tax holiday for seamen engaged in international transportation of freight;

- abolishing the tax credit for patronage gift.

Finally, the deduction relating to the acquisition of an income-averaging annuity respecting income from artistic activities will be abolished for new income-averaging annuities respecting income from artistic activities acquired after the 2025 taxation year.

Measures pertaining to businesses

Implementing a new tax assistance system fostering scientific research and experimental development activities

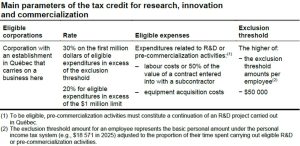

Introducing a tax credit for R&D, innovation and pre-commercialization

An eligible corporation that will incur, in a taxation year, “expenditures relating to R&D activities” or “expenditures relating to pre-commercialization activities” will be able to benefit, under certain conditions, from the tax credit for R&D, innovation and pre-commercialization (hereinafter referred to as the “CRIC”).

Similarly, a corporation, other than an excluded corporation, that is a member of an eligible partnership, will be able to benefit, under certain conditions, from the CRIC on its share of expenditures relating to R&D activities or expenditures relating to pre-commercialization activities incurred by the eligible partnership in a fiscal period.

The basic rate of this refundable tax credit will be 20%.

This rate may be increased to 30% for a maximum of $1 million (hereinafter referred to as the “expenditure limit”) in expenditures relating to R&D activities or expenditures relating to pre-commercialization activities of an eligible corporation that exceed the amount of the applicable exclusion threshold, regardless of its assets.

Expenditures relating to R&D activities (or pre-commercialization) will include salaries and wages, considerations paid to subcontractors, payments made to certain research organizations as well as capital expenditures relating to the acquisition of property incurred by the eligible corporation or eligible partnership in respect of R&D activities (or pre-commercialization).

The exclusion threshold for a business’s eligible expenditures will correspond to the higher of:

- the basic personal amount under the personal income tax system applicable for each employee, adjusted to the proportion of their time spent carrying out eligible R&D or pre-commercialization activities;

- $50 000.

See main parameters of the CRIC in Appendix 1.

Eligible corporation

The tax legislation will be amended so that the expression “eligible corporation” will mean a corporation, other than an excluded corporation, which, in the year, operates a business in Québec and undertakes in Québec or causes to be undertaken on its behalf in Québec as part of a contract, R&D activities or pre-commercialization activities in respect of a business of the corporation.

Excluded corporation

An excluded corporation will mean a corporation which is one of the following corporations:

- a corporation exempt from tax;

- a Canadian Crown corporation or a wholly-controlled subsidiary of such a corporation;

- a corporation that is controlled[1], directly or indirectly in any manner whatever, by one or a combination of the following entities, at any time during the 24 months preceding the date on which an R&D contract or a pre-commercialization contract was entered into:

- an eligible university entity,

- an eligible public research centre,

- an eligible research consortium,

- a trust one of the capital or income beneficiaries of which is one of the entities listed above,

- a corporation carrying on a personal services business.

Eligible partnership

The tax legislation will be amended so that the expression “eligible partnership” will mean a partnership which, in the fiscal period, operates a business in Québec and undertakes in Québec or causes to be undertaken on its behalf in Québec as part of a contract, R&D activities or pre-commercialization activities in respect of a business of the partnership.

Calculating the tax credit

An eligible corporation will be able to determine the allocation of the expenditure limit between its expenditures relating to R&D activities and its expenditures relating to pre-commercialization activities.

In the case of a taxation year of less than 51 weeks, the amount of the expenditure limit will be adjusted to reflect the number of days in the taxation year.

Where an eligible corporation will be a member of an associated group, in a taxation year, the expenditure limit will have to be the subject of a sharing agreement between the members of the associated group in accordance with the usual rules.

Capital expenditure relating to the acquisition of property used in R&D activities/pre-commercialization

A capital expenditure relating to the acquisition of property used in R&D activities (or pre-commercialization) will mean a capital expenditure for all or substantially all of its operating time during its expected useful life for R&D activities (or pre-commercialization) undertaken directly by the corporation or partnership, or on its behalf, in respect of a business of the corporation or partnership.

However, it will not include a capital expenditure relating to the acquisition of:

- land or a leasehold interest in such land;

- a building, including a leasehold interest in such building;

- a right to use a building.

In addition, the property must not, before its acquisition, have been used for any purpose nor have been acquired to be used or leased for any purpose whatever.

A capital expenditure for the acquisition of property used in R&D (or for pre-commercializaton activities) will be deemed not to have been incurred before the property is considered available for use.

Pre-commercialization activity

A pre-commercialization activity will mean, except to the extent that such activity constitutes an R&D activity, all of the following activities:

- tests, technological validations and studies carried out to meet regulatory requirements and aimed at obtaining a registration or certification for the purpose of commercializing a product or process, provided that such activities constitute a continuation of R&D activities undertaken in Québec by the eligible corporation or eligible partnership or caused to be undertaken on its behalf in respect of a business of the corporation or partnership;

- product design, provided that such activities constitute a continuation of R&D activities undertaken in Québec by the eligible corporation or eligible partnership in respect of a business of the corporation or partnership.

Other terms and conditions

The amount of any government or non-government assistance, and of any benefit or advantage attributable to expenditures relating to R&D activities or expenditures relating to pre-commercialization activities will have to be withdrawn from the amount of expenditures, in accordance with the usual rules. An amount received as an investment tax credit under the federal tax system will not, however, constitute government assistance for the purposes of the CRIC.

The rules relating to contract payments currently in effect for the purposes of the tax credit for salaries (R&D) and the R&D tax credit (research contract) will apply to the CRIC with the necessary adaptations.

In the event that expenditures relating to R&D activities or expenditures relating to pre-commercialization activities are reimbursed in whole or in part, the CRIC granted in respect of an amount thus reimbursed will be recovered by means of a special tax in accordance with the usual rules.

The portion of the CRIC attributable to the acquisition of property used in R&D or pre-commercialization activities, as the case may be, will be recovered by means of a special tax, according to the usual rules, where such property ceases, during the minimum period of 730 consecutive days following the beginning of the use of the property (otherwise than by reason of its loss, of its involuntary destruction caused by fire, theft or water, or of a major breakdown), to be used solely in Québec in whole or in substantial part in R&D or pre-commercialization activities undertaken by the eligible corporation or eligible partnership, or by a person with which the corporation or partnership does not deal at arm’s length and which has acquired the property in circumstances where there has been a transfer, amalgamation or winding-up.

The rules aimed at avoiding the accumulation of tax assistance for an expenditure that can give rise to more than one tax credit, for more than one taxpayer or for one taxpayer will also apply.

Similarly, an eligible corporation or a corporation that is a member of an eligible partnership for which an initial qualification certificate was issued for the purposes of the tax holiday relating to the carrying out of a large investment project (the former TH-LIP) as well as for the purposes of the new deduction relating to the carrying out of a large investment project will not be able to claim the CRIC for property used, or acquired to be used, as part of a large investment project.

Complementarity of the CRIC with the federal SR&ED tax credit

The CRIC will support business salaries and wages beyond the R&D stage (pre-commercialization), while the addition of equipment expenditures will encourage the acquisition of technologies and properties used in R&D or pre-commercialization activities.

As these expenditures are not currently eligible for the federal government’s SR&ED tax credit, the related CRIC assistance will not affect the amount of federal tax assistance.

For R&D salary and wage expenditures, a business will be able to combine the two tax credits.

Application date

The CRIC will apply to a taxation year or a fiscal period, as the case may be, beginning March 26, 2025.

Consequential adjustments of certain fiscal measures

Incentive deduction for the commercialization of innovations in Québec (IDCI)

The tax legislation will be amended as a result of the implementation of the CRIC and the abolition of the tax credit for salaries (R&D) and the R&D tax credit (research contract) in order to adjust the variables of the fraction considered for the calculation of the Québec nexus ratio of a qualified corporation for the purposes of the IDCI.

Application date

These changes will apply to a taxation year that will begin after March 25, 2025.

Securities options deduction

The tax legislation will therefore be amended so that a corporation will qualify as a qualified corporation for a calendar year for the purposes of the security options deduction if, in the calendar year, the corporation carries on a business in Québec and has an establishment there and if an amount under the CRIC was allocated to it for its taxation year ended in the calendar year or if, for one of the three preceding taxation years, either an amount under the CRIC was allocated to it or the corporation’s assets as shown in its financial statements were less than $50 million and an amount under one of the former tax credits for R&D was allocated to it. This change will apply as of the 2026 calendar year. In addition, for the 2025 calendar year, a corporation will qualify as a qualified corporation for the purposes of the security options deduction if, in 2025, it carries on a business in Québec and has an establishment there, and if the following conditions are met:

- either an amount in respect of the CRIC was granted to it for a taxation year ended in 2025; or

- an amount in respect of one of the former tax credits for R&D was granted to it for a taxation year ended in 2025, or for one of the three preceding taxation years, and the corporation had assets of less than $50 million shown in its financial statements for 2025 or one of the three preceding taxation years.

Consequential abolition of certain fiscal measures

As a result of the implementation of the CRIC, the following tax credits will be abolished in respect of a taxation year of a taxpayer or a fiscal period of a partnership, as the case may be, beginning after March 25, 2025:

- tax credit for scientific research and experimental development;

- tax credit for university research and for research carried on by a public research centre or a research consortium;

- tax credit for private partnership pre-competitive research;

- tax credit for fees and dues paid to a research consortium;

- tax credit for technological adaptation services.

Also, the industrial design component of this tax credit will be abolished. Consequently, no expenditure relating to the industrial design component will be eligible for the tax credit where it is incurred by a corporation or a partnership for salaries or under an external consulting contract, for a taxation year or fiscal period, as the case may be, beginning after March 25, 2025.

For greater clarity, this tax credit will remain unchanged with regard to the fashion design component and will continue to apply to expenditures relating to this component.

See summary of changes to the tax assistance for innovation in Appendix 2.

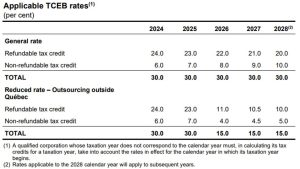

Modernization of the tax credits for the development of e-business

Changes will be made to modernize the eligible activities for the tax credit for the development of e-business (TCEB) purposes. These changes consist in:

- refocusing eligible activities for TCEB purposes on e-business integrating artificial intelligence (AI) functionalities to a significant extent;

- relaxing the criteria relating to activities and the criterion relating to services provided by adding data processing and hosting activities, to promote the eligibility of AI businesses;

- removing activities relating to maintenance or evolution.

In addition, a change will also be made to reduce the tax assistance to corporations that provide services to persons with whom they are not dealing at arm’s length, in relation to an application intended to be used exclusively outside Québec.

Modernization of the eligible activities for TCEB purposes

Refocusing on e-business integrating artificial intelligence functionalities to a significant extent

The Sectoral Act will be amended so that, to be an eligible activity, for employee certificate purposes, an activity must be primarily related to e-business integrating AI functionalities to a significant extent.

For greater clarity, an activity will be considered, in respect of an employee, to be primarily related to e-business integrating AI functionalities to a significant extent, when the duties performed by the employee are primarily related to e-business and relate to a mandate, a project or a product that integrates AI functionalities to a significant extent.

Adding data processing and hosting activities for the purposes of the criteria relating to activities and the criterion relating to services provided

The Sectoral Act will be amended to add the data processing, hosting and related services activities included in the group described under NAICS code 51821 to the list of NAICS codes that meet the 50% test, for the purposes of the criteria relating to activities.

Consequently, the Sectoral Act will be amended so that the data processing, hosting and related services activities included in the group described under NAICS code 51821 are eligible activities considered in analyzing the criterion relating to services provided for corporation certificate purposes.

For greater certainty, the criterion relating to services provided will therefore be met where at least 75% of the corporation’s gross revenue deriving from activities included in the groups described under NAICS codes 511210 (software publishers), 51821 (data processing, hosting and related services), 541510 (computer systems design and related services), 561320 (temporary help services) and 561330 (professional employer organizations) is attributable to all of the following services:

- services whose ultimate beneficiary is a person or a partnership with whom the corporation is dealing at arm’s length; or

- services that relate to an application developed by the corporation and used exclusively outside Québec.

In addition, where services are provided to a particular person as part of activities included in the groups described under NAICS codes 561320 (temporary help services) and 561330 (professional employer organizations), these services must ultimately relate to an application that results from activities described in NAICS codes 511210 (software publishers), 51821 (data processing, hosting and related services) and 541510 (computer systems design and related services) that have been developed for the benefit of the particular person.

Removing activities relating to maintenance or evolution

The Sectoral Act will be amended to remove activities relating to maintenance or evolution from eligible activities, for employee certificate purposes.

Application date

These amendments will apply, for both refundable and non-refundable tax credits, in respect of a taxation year beginning after December 31, 2025.

These amendments may also apply, where the corporation files an election in writing with Investissement Québec, for a taxation year that begins after March 25, 2025 and before January 1, 2026. However, such an election in writing must be filed by the corporation before the expiry of the ninth month following the due date for filing its tax return for the taxation year concerned.

In addition, these two tax credits will be renamed, as of the effective date of these amendments, so as to be referred to as “refundable tax credit for the development of e-business integrating artificial intelligence” and “non-refundable tax credit for the development of e-business integrating artificial intelligence.”

Reducing the tax assistance granted to corporations that carry out intercompany outsourcing

The tax legislation will be amended to reduce the tax assistance provided to corporations that carry out intercompany outsourcing.

Accordingly, the Sectoral Act will be amended to clarify that the corporation certificate will now have to specify the proportion of a corporation’s gross revenue derived from activities included in the groups described under NAICS codes 511210 (software publishers), 51821 (data processing, hosting and related services) and 541510 (computer systems design and related services) that is attributable to services that relate to an application developed by the corporation to be used exclusively outside Québec by an ultimate beneficiary who is a person or a partnership with whom the corporation is not dealing at arm’s length.

The Sectoral Act will also be amended to clarify that the corporation certificate will now have to specify the proportion of a corporation’s gross revenue deriving from activities included in the groups described under NAICS codes 561320 (temporary help services) and 561330 (professional employer organizations) that is ultimately attributable to services provided relating to an application developed in connection with activities included in the groups described under NAICS codes 511210 (software publishers), 51821 (data processing, hosting and related services) and 541510 (computer systems design and related services) to be used exclusively outside Québec by an ultimate beneficiary who is a person or a partnership with whom the corporation is not dealing at arm’s length.

The tax legislation will also be amended to provide that when any one of these proportions is at least 50%, the rates applicable to the TCEB, both for the refundable and non-refundable tax credit, will correspond to half of the rates otherwise applicable for that taxation year.

The table below sets out the TCEB rates following these amendments.

Application date

These amendments will apply, for both refundable and non-refundable tax credits, in respect of a taxation year beginning after December 31, 2025.

Changes to the refundable tax credit relating to mining or other resources

Changes will be made to the tax credit relating to resources. These changes consist in:

- adding development expenses to the eligible expenses for the tax credit;

- revising the tax credit rates applicable to the eligible expenses related to mining resource;

- enhancing the rates applicable to projects related to critical and strategic minerals until December 31, 2029;

- introducing a limit on eligible expenses of $100 million per five-year period.

See the main parameters of the tax credit relating to resources applicable to mining resource expenses in Appendix 3.

Consequential adjustments of the tax benefits relating to the flow-through share regime

An individual can benefit from an additional deduction of 10% in respect of certain exploration expenses incurred in Québec. On the other hand, the individual can also benefit from an additional deduction of 10% in respect of certain surface mining exploration expenses incurred in Québec.

The tax legislation will be amended to abolish the additional deduction in respect of certain exploration expenses incurred in Québec as well as the additional deduction in respect of certain surface mining exploration expenses incurred in Québec.

Application date

These changes will apply to flow-through shares issued after March 25, 2025.

However, they will not apply to shares issued after that day, but before January 1, 2026, when they are issued following an application for a receipt for a preliminary prospectus made on or before March 25, 2025.

Similarly, the changes will not apply to shares issued after March 25, 2025 when they are issued following a public announcement made on or before that day, if the report of distribution form has been submitted to the Autorité des marchés financiers on or before May 31, 2025.

Consequential abolition of the additional capital gains exemption in respect of certain resource properties

The tax legislation will be amended to abolish the additional capital gains exemption in respect of certain resource properties.

Application date

This abolition will apply to dispositions made after March 25, 2025.

Extension of the tax credit for the digital transformation of print media

The tax legislation will be amended to extend the assistance granted under the refundable tax credit by one year. As a result, the eligibility period for the refundable tax credit will end on December 31, 2025. In addition, to qualify as a qualified property, the property must be acquired before January 1, 2025.

Abolishing the tax credit to foster synergy between Québec businesses

The tax credit will therefore be abolished as of March 26, 2025.

Introducing a due date for additional deductions for public transit and shared transportation

The tax legislation will be amended to introduce, for the additional deduction relating to public transit passes as well as for the additional deduction relating to the organization of an intermunicipal shared transportation service, a December 31, 2027 due date.

Consequential adjustment providing for taxation of the benefit received from an employer in connection with the use of public transit or shared transportation services

The tax legislation will be amended to state that an individual must include, in computing their income, the value of the benefit received by the individual from his employer after December 31, 2027 in respect of an eligible transit pass, an eligible paratransit pass or the benefit resulting from the use of an intermunicipal shared transportation service.

Measures pertaining to commodity taxes

Harmonizing the rate of the tax on insurance premiums with that of the Québec sales tax

The rate of the tax on insurance premiums will be set at the same rate as the Québec sales tax. As a result, the tax on insurance premiums at the rate of 9.975% will apply to insurance premiums paid after December 31, 2026.

Abolishing the fuel tax refund for biodiesel

The fuel tax system will be amended to abolish this refund. This change will apply to biodiesel acquired after March 25, 2025.

Other measures

Relaunching the Roulez vert program

The Québec government confirms that the Roulez vert program will once again be accessible as of April 1, 2025 for the purchase of electric vehicles.

The maximum rebates for the acquisition of electric vehicles will be:

- $4 000 for new fully electric or fuel cell vehicles and $2 000 for new plug-in hybrid vehicles costing less than $65 000;

- $2 000 for used fully electric vehicles and $1 000 for electric motorcycles.

Rebates for the purchase of an electric vehicle will be reduced gradually and will stop being offered on vehicles registered on or after January 1, 2027.

Introducing an annual contribution for electric and plug-in hybrid vehicles

An annual contribution of $125 for electric vehicles and $62.50 for plug-in hybrid vehicles will be introduced.

The new fee will be in addition to fees payable to put a vehicle on the road after December 31, 2026, or to fees payable to retain the right to drive after that date. It will subsequently be indexed annually.

Ending free access to toll bridges and ferries for electric and plug-in hybrid vehicles

The government is announcing that it will not be extending free access to toll bridges and ferries for vehicles with green licence plates beyond March 31, 2027.

Ending indexation of the eligibility threshold for reduced rates of employer contributions to the Health Services Fund

The government is announcing the end of indexation of the payroll threshold entitling to reduced rates of employer contributions to the Health Services Fund, which will be maintained at $7.8 million.

Changing the public utility tax

Budget 2025-2026 provides for public utility tax rates to be increased from 2027 onward, reaching a flat rate of 1.5% in 2035.

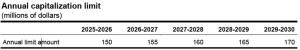

Changes to various parameters of Capital régional et coopératif Desjardins

These amendments are aimed at:

- setting the annual capitalization limit applicable until February 28, 2030;

- introducing a cumulative subscription ceiling for each current and future shareholder;

- introducing a new class of shares with a maximum holding period of 14 years, entitling the holder to a non-refundable tax credit calculated at a reduced rate.

Setting the annual capitalization limit

The Capital régional et coopératif Desjardins (CRCD) constituting act and tax legislation will be amended so that the amount that CRCD will be able to raise will be temporarily set for the acquisition periods between March 1, 2025 and February 28, 2030.

The annual limit amount will therefore correspond to the ceilings shown in the following table.

Introduction of a cumulative subscription ceiling

The tax legislation will be amended to introduce, for all classes of shares of CRCD’s authorized share capital, a cumulative subscription ceiling of $45 000 per shareholder, which will be applicable to both current and future CRCD shareholders, subject to the following:

- individuals who, on March 25, 2025, have subscribed to CRCD shares for which they have paid an amount totalling more than $45 000 will be able to keep all these shares and the related tax credits;

- amounts paid in respect of the following shares will not count toward an individual’s cumulative subscription ceiling:

- shares obtained by an individual as a result of the devolution of an estate,

- shares redeemed by CRCD within 30 days of subscription,

- shares purchased by agreement because no tax credit was obtained, in accordance with CRCD’s purchase by agreement policy.

This cumulative subscription ceiling of $45 000 per shareholder will apply as March 26, 2025.

Introduction of a new share class

The CRCD constituting act will be amended to introduce a new class of shares to its authorized share capital, namely class C shares. These shares may be held for a maximum period of 14 years. The first purchaser of such shares will be entitled to a non-refundable tax credit at a rate of 25%. Amounts paid by an individual during an acquisition period cannot exceed $5 000. Accordingly, the maximum amount that this tax credit can reach is $1 250.

From the capitalization period beginning March 1, 2025, only class C shares or class C fractional shares may be issued by CRCD in connection with a new subscription to its share capital.

Introducing a new reporting requirement for foreign property held outside Canada

The new reporting requirement for foreign property held outside Canada will be satisfied by a new prescribed form to be completed and filed with Revenu Québec for a taxation year or fiscal period, as the case may be, taking into account the parameters set out below.

Definition of “designated foreign property”

For the purposes of the Québec tax system, designated foreign property that will be subject to the new reporting requirement will be essentially the same as foreign property subject to the federal tax legislation, with the necessary adaptations.

Definition of “reporting entity”

A person or an entity which will be required to file with the Québec Minister of Revenue a report in respect of designated foreign property it holds, for a taxation year or fiscal period, as the case may be, will mean a designated Québec entity whose total of all amounts each of which is the total cost amount, to the person or entity, of a designated foreign property exceeds $100 000, at any time in the taxation year or fiscal period, other than a time when the person or entity is not resident in Canada.

Definition of “designated Québec entity”

A designated Québec entity will mean:

- an individual resident in Québec in a taxation year;

- a corporation that simultaneously resides in Canada and has an establishment in Québec for that taxation year;

- a trust that is a resident in Québec in a taxation year;

- a partnership where the partner’s share of the income or loss is less than 90% of the partnership’s income or loss for the fiscal period.

Filing-due date of the new Québec prescribed form

The new Québec prescribed form will need to be filed with Revenu Québec by a reporting entity on or before the same filing-due date as that of the tax return applicable to the reporting entity for the year, except if the entity is a partnership, in which case the filing-due date will be the same as that of the information return (or the one that would apply if the partnership were to file one).

Introducing new penalties

The Québec tax legislation will be amended to introduce penalties corresponding to those in the federal tax system, in particular:

- a penalty for failing to file the new Québec form of $500 per month or part of a month for a maximum of 24 months, that is, a maximum of $12 000, and, where the entity has been given formal notice to file the new return and has failed to meet the deadline, the double of that amount;

- an additional penalty for failing to file the report for more than 24 months set at 5% of the total cost of the designated foreign property;

- a penalty in case of false statement or omission equal to or higher than $24 000 or 5% of the total cost of designated foreign property.

Extending the assessment period

As in the federal tax legislation, an extension of three years after the end of the normal reassessment period for the taxpayer in respect of the year will be introduced.

Application date

These measures will apply as of a date to be determined by the government after the assent of the bill giving effect to them.

Position of the Ministère des Finances du Québec –Government of Canada’s 2024 Fall Economic Statement

The Ministère des Finances du Québec wishes to make public its position on these new federal tax measures.

Measures retained

Québec tax legislation and regulations will be amended to incorporate, with adaptations on the basis of their general principles, the measures relating to:

- the exemption of the Canada Disability Benefit from tax;

- capital gains rollover on investments;

- reporting by non-profit organizations;

- the scientific research and experimental development tax incentive program (SR&ED), with respect to the eligibility of capital expenditures for the deduction relating to SR&ED expenditures;

- the extension of the Accelerated Investment Incentive and immediate expensing measures, subject to the rules set out below.

Qualifying intellectual property included in Class 14.1

A qualifying intellectual property included in Class 14.1 which becomes available for use before 2026 benefits from a temporary accelerated capital cost allowance under the Québec tax system.

Consequently, the extension of the Accelerated Investment Incentive will not apply to such a property.

Deduction for Canadian development expenses

The extension of the Accelerated Investment Incentive will not apply to the deduction for cumulative Canadian development expenses claimed by a development corporation carrying on a mining business, neither will it apply to the deduction for cumulative Canadian development expenses incurred in Québec claimed by a development corporation carrying on an oil business.

Measures not retained

Certain measures have not been retained because they do not correspond to the characteristics of the Québec tax system or because the latter is satisfactory or does not contain similar provisions. These measures relate to:

- the Canada Carbon Rebate Rural Supplement;

- the reclassification of the islands of Haida Gwaii for the purposes of the Northern residents deduction;

- the Canada Carbon Rebate for Small Businesses;

- the clean electricity investment tax credit for provincial and territorial Crown corporations;

- the clean electricity investment tax credit and the Canada Infrastructure Bank;

- the EV supply chain investment tax credit;

- the clean hydrogen investment tax credit – methane pyrolysis;

- the scientific research and experimental development tax incentive program, with respect to the expenditure limit and taxable capital phase-out thresholds, the extension of the enhanced refundable tax credit to eligible Canadian public corporations, including elections for Canadian-controlled private corporations, and the eligibility of capital expenditures for computing the tax credit.

Appendix 1

Appendix 2

Appendix 3

Notice to Users

The reproduction of the contents of this Québec budget summary is authorized without restriction.

This budget summary is based on the documents issued by the Québec government. The legislation, when enacted, may vary from the summary described herein. Professional advice should be obtained.

PSB BOISJOLI LLP has acted solely as publisher of this budget summary. Consequently, neither PSB BOISJOLI LLP nor any person involved in its preparation accepts any form of liability for its contents or for any consequences arising from its use.

[1] A corporation related to such a corporation will also be an excluded corporation for the purposes of the CRIC.